The sheepmeat complex remains under the influence of seasonal conditions and forced turnoff across southern Australia.

Hot and dry January weather has burnt off any pastures that were remaining, while stock water availability is a widespread problem from central and western Victoria, through South Australia and into Western Australia.

Parts of the New South Wales Tablelands have received some good rain in the past few weeks which has allowed the planting of forage crops and has slowed stock turnoff from these areas. Another good follow-up rain will position these areas well for the upcoming season.

The story is far different in other major lamb producing areas which are moving into their third year of below average rainfall. In contrast to previous years though, the lack of any meaningful summer rainfall so far, means that these areas will enter autumn with very little subsoil moisture making them reliant on a significant autumn break and ongoing rainfall through the southern wet season.

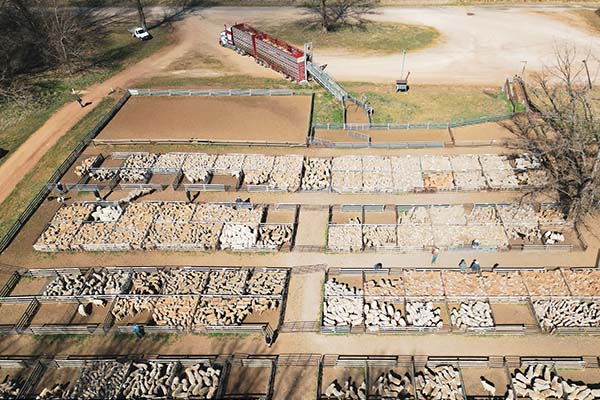

After showing some signs of falling back to more normal levels at the end of 2024, sheep and lamb slaughter has pinged higher again as producers continue to liquidate sheep flocks in response to seasonal conditions. Supplies of heavy sheep and lambs above 26kg dressed weight are starting to tighten, particularly through the saleyards where yardings are now mostly comprised of mixed quality lighter sheep and lambs.

Lamb slaughter pings higher

After falling below 23/24 levels during the last quarter of 2024, lamb slaughter has bounced back above year ago levels during the early part of 2025.

Unless it remains dry its doubtful that these higher slaughter levels are maintained through autumn and winter.

This chart shows Australian lamb slaughter in 24/25 versus 23/24 and the seven-year average. Source: National Livestock Reporting Service

This chart shows Australian lamb slaughter in 24/25 versus 23/24 and the seven-year average. Source: National Livestock Reporting Service

The message from our agent network remains that lamb supplies are set to tighten as we move through summer into autumn. This is a result of the heavy ewe cull the past few years, lower joinings and lambing percentages (hearing that lamb scanning rates for the coming lamb drop out of SA are dire) are due to adverse seasonal conditions across the south. Last year’s lamb drop was the lowest in several years which will mean lamb slaughter should ease sometime in 2025.

Flock liquidation increases sheep kill

Sheep slaughter remains well above year ago levels and long-term averages in a sign that sheep producers have moved to liquidate flocks.

Poor pasture availability and lack of stock water is a common theme right across southern Australia.

This chart shows Australian sheep slaughter in 24/25 vs 23/24 and the seven-year average. Source: National Livestock Reporting Service.

This chart shows Australian sheep slaughter in 24/25 vs 23/24 and the seven-year average. Source: National Livestock Reporting Service.

Speaking with our agents, some have commented that there doesn’t seem to be any desire to look towards rebuilding sheep flocks that have been reduced the last few years due to low prices in 2023 and poor seasonal conditions. The increased labour requirement of running sheep is central to this decision with many opting to either increase cropping where possible or increase cattle numbers in livestock areas.

Export demand and tightening supply should lead a recovery in heavy lamb values

Heavy lamb values have been dragged lower by weakness across the entire sheepmeat complex as producers continue to liquidate flocks and turnoff lambs early.

Export demand for heavy lambs from the US for Greek Easter will increase in late February to March and with good heavy lambs becoming harder to find this should lead a price recovery in heavy lamb values through autumn.

This chart shows the national saleyard indicators prices for heavy lambs this year vs 23/24 and seven-year avg. Source: MLA.

This chart shows the national saleyard indicators prices for heavy lambs this year vs 23/24 and seven-year avg. Source: MLA.

Tightening availability of heavier lambs to support trade lamb values

Trade lamb values have sunk below year ago levels; however, Elders agents are reporting that trade lamb supplies are starting to dwindle as the season takes its toll on supplies.

Like with heavy lamb values, as supplies slow these lamb categories will be the first to see higher values and will start to push back above year ago levels.

This chart shows the national saleyard indicators prices for trade lambs this year versus 23/24 and seven-year average. Source: MLA

This chart shows the national saleyard indicators prices for trade lambs this year versus 23/24 and seven-year average. Source: MLA

Light lamb values under pressure from larger supplies

Light lambs have been dealt with the harshest as the season leads producers to turnoff lambs lighter than they would normally be. Until we see a decent autumn break across the south, light lamb values will continue to struggle as saleyards contain a high proportion of these lambs.

This chart shows the national saleyard indicators prices for light lambs this year versus 23/24 and seven-year average. Source: MLA

This chart shows the national saleyard indicators prices for light lambs this year versus 23/24 and seven-year average. Source: MLA

Restocker demand falls with feeding economics

Strong feeding margins supported restocker lamb values throughout the last quarter of 2024. However, with feed barley values rising and finished lamb values falling, the appetite to feed livestock has started to wane as the economics turn for the worse. The critical stock water situation in many areas would also be discouraging feeding lambs.

Restocker lamb values look under pressure until seasonal conditions change.

This chart shows the national saleyard indicators prices for restocker lambs this year versus 23/24 and seven-year average. Source: MLA

This chart shows the national saleyard indicators prices for restocker lambs this year versus 23/24 and seven-year average. Source: MLA

Mutton cruelled by flock liquidation

With producers continuing to liquidate their flock’s, mutton values have borne the brunt of the downturn with values slipping well below year ago levels. Heavy mutton is becoming increasingly difficult to find with direct to work quotes starting to firm. Lighter mutton is harder to place.

This chart shows the national saleyard indicators prices for mutton this year versus 23/24 and seven-year average. Source: MLA.

This chart shows the national saleyard indicators prices for mutton this year versus 23/24 and seven-year average. Source: MLA.

In Western Australia, the last month has seen increased sheep turnoff and larger saleyard numbers as it remains dry and hot and many southern areas run out of stock water. With processors fully booked for the next 2 to 3 weeks the options remain limited. Feedlots have been taking sheep but are now mostly full.

The industry will be looking to a couple of live export boats in the next few weeks to ease the burden, however, ships continue to be ordered back to dry dock making planning difficult. Interest from the east has dried up as water issues and a fall in east coast prices make trucking sheep from WA less attractive.

Again, price trends for mutton will be dictated by the season with a good, widespread autumn break seeing a step change in prices. The last few weeks have seen prices stabilise as much of the turnoff has happened.

From the rails

Read what Elders livestock representatives from around Australia are saying about the markets in their regions.

| NSW sheepmeat saleyard indicators | ||||

| 20Feb 25 | +/- week | +/- month | +/- year | |

| Lambs | ||||

| Heavy | 833 | 786 (+47) | 807 (+26) | 658 (+175) |

| Trade | 600 | 783 (+17) | 783 (+17) | 626 (+174) |

| Light | 697 | 708 (-11) | 692 (+5) | 556 (+141) |

| Restocker | 718 | 707 (+11) | 8709 (+8) | 537 (+181 |

| Mutton | 393 | 371 (+22 | 346 (+47) | 291 (+102) |

Source: MLA

“Everything is going well, sheep are gaining a bit of momentum carrying on from last week on the lighter sheep, the heavier sheep have stayed steady.

Running out of good lambs in the physical markets, most are going over the hook so not seeing big runs of good lambs in saleyards. Most are around $7.60 to $8/kg dw on your lambs and we are seeing $4 to $4.20/kg for sheep.

Water is becoming an issue through central Vic into the western district with stock coming onto the market that have no had access to good water. Stock in most areas are holding up but that’s going to be the issue until we get rain.” - Nigel Starick, Livestock Manager, Bendigo.

| Victorian sheepmeat saleyard indicators | ||||

| 21Feb25 | +/- week | +/- month | +/- year | |

| Lambs | ||||

| Heavy | 808 | 782 (+26) | 819 (-8) | 644 (+174) |

| Trade | 786 | 762 (+24) | 804 (-18) | 618 (+168) |

| Light | 778 | 707 (+71) | 770 (+8) | 605 (+173) |

| Restocker | 701 | 663 (+38) | 703 (-2) | 514 (+187) |

| Mutton | 379 | 336 (+43) | 358 (+21) | 274 (+105) |

Source: MLA

| SA sheepmeat saleyard indicators | ||||

| 21 Feb 25 | +/- week | +/- month | +/- year | |

| Lambs | ||||

| Heavy | 733 | 702 (+31) | 790 (-57) | 625 (+108) |

| Trade | 747 | 732 (+15) | 781 (-34) | 658 (+89) |

| Light | 697 | 723 (-26) | 690 (+7) | 613 (+84) |

| Restocker | 687 | 698 (-11) | 673 (+14) | 435 (+252) |

| Mutton | 328 | 286 (+42) | 343 (-15) | 203 (+125) |

Source: MLA

“Pretty tough in the markets last week. We had some big yardings due to water issues and the lack of processing space knocked us again. So, the last 3 weeks have been trending down but last week it took a real dive where mutton was back $20/head and lambs $30-35/head. In the yards $2.80/kg dw on mutton and $6.80/kg dw for lambs.

The processors have kept their prices where they were at $3.40/kg dw for mutton and $7.40/kg for lambs, but you can’t get a slot for at least two weeks. So that’s creating a few issues.

There is a live export boat for 60,000 head but there is already a carryover of 30,000 head from one that was ordered back into dry dock a couple of weeks ago. Subject to getting out of dry dock another boat is expected in around two weeks. But every time we get an export order the boat seems to get ordered back into dry dock.

Mated ewes, we wouldn’t know where to go to sell one, with the dry conditions and lack of water. There’s plenty on offer but no one is interested, particularly in WA but no interest from the eastern states.

We have pushed our feeder lamb sale back towards the end of March to hopefully line-up with the next live export boat. With the oversupply of sheep, the big feedlots are full. So, when we have the sale, we want to make sure they have somewhere to go.” - Wayne Peake – Livestock Sales Manager, WA.

| WA sheepmeat saleyard indicators | ||||

| 21 Feb 25 | +/- week | +/- month | +/- year | |

| Lambs | ||||

| Trade | 551 | 580 (-29) | 731 (-180) | 543 (+8) |

| Light | 414 | 405 (+9) | 569 (-155) | 414 (n/c) |

| Restocker | 443 | 460 (-17) | 690 (-247) | 284 (+159) |

| Mutton | 229 | 201 (+28) | 295 (+66) | 100 (+119) |

Source: MLA

“Lambs have pulled back around 10c/kg in over the hooks markets back to about $7.40/kg dw in the saleyards it was a bit different, prices picked up to about $7.50-7.60/kg dw, depending on weight and quality.

Mutton best of them $4/kg dw with most $3.70-3.80/kg. So ticking along but we are still looking for a break.” - Gavin Coombe, State Livestock Manager, Tasmania.

| TAS sheepmeat saleyard indicators | ||||

| 21 Feb 25 | +/- week | +/- month | +/- year | |

| Lambs | ||||

| Trade | 659 | 703 (-44) | 739 (-80) | 587 (+72) |

| Light | 691 | 671 (+20) | 723 (+32) | 457 (+234) |

| Restocker | 647 | 673 (-26) | 702 (-55) | 296 (+351) |

| Mutton | 345 | 344 (+1) | 370 (+25) | 155 (+190) |

Source: MLA

Sources: Price data reproduced courtesy of Meat & Livestock Australia Limited.

*Disclaimer – important, please read:

The information contained in this article is given for general information purposes only, current at the time of first publication, and does not constitute professional advice. The article has been independently created by a human author using some degree of creativity through consultation with various third-party sources. Third party information has been sourced from means which Elders consider to be reliable. However, Elders has not independently verified the information and cannot guarantee its accuracy. Links or references to third party sources are provided for convenience only and do not constitute endorsement of material by third parties or any associated product or service offering. While Elders has exercised reasonable care, skill and diligence in preparation of this article, many factors including environmental/seasonal factors and market conditions can impact its accuracy and currency. The information should not be relied upon under any circumstances and, to the extent permitted by law, Elders disclaim liability for any loss or damage arising out of any reliance upon the information contained in this article. If you would like to speak to someone for tailored advice specific to your circumstances relating to any of the matters referred to in this article, please contact Elders.